The last time government red ink posed such a dire threat was during the founding of the republic.

America’s long-term national debt now exceeds $14 trillion, a figure that is almost impossible for most people to wrap their minds around. In relative terms, that is roughly equivalent to the nation’s entire economic output last year. And the challenge we face in preventing the debt from becoming an overwhelming burden on our children and grandchildren hearkens back to the founding era, when the fledgling republic was teetering on the edge of bankruptcy.

Alexander Hamilton, the first secretary of the treasury, proclaimed, “A national debt, if it is not excessive, will be to us a national blessing.” He was right. We survived and prospered as a young nation because of Hamilton’s efforts to consolidate and guarantee the enormous national debt incurred during the Revolution. During the Civil War, we used the national debt to save the Union. During the Great Depression, we used it to save the American economy. During World War II, we used it to save the world.

In recent decades, however, the national debt has skyrocketed. We crossed the $1 trillion threshold under President Ronald Reagan (and reached $3 trillion by the time he left office), then surpassed $4 trillion under George H.W. Bush, $5 trillion under Bill Clinton, $10 trillion under George W. Bush, and $14.3 trillion so far under Barack Obama. Meanwhile, since 1980 the debt has increased from 34.5 percent of gross domestic product, a measure of the total goods and services produced nationwide, to 97.9 percent. On the pages that follow, we chronicle how the national debt has evolved from a strategic tool for advancing the interests of the nation into a monstrous threat to our economic and political stability.

Alexander Hamilton Transforms Debt Into a National Blessing

The United States was born in debt. We had to fight to come into existence as a sovereign country, and war is an expensive business. The Continental Congress borrowed from foreign governments, especially France, as well as from American citizens, and printed reams of paper continentals with no intrinsic value that caused hyperinflation. “Not worth a continental” became a standard phrase in the American lexicon for a hundred years.

At the end of the Revolution, the central government was unable to pay either the interest or principal on our debts because it lacked the power to tax. Instead it had to requisition money from the states, which sometimes paid and sometimes did not.

The disastrous fiscal situation exposed the inadequacy of the Articles of Confederation and was the primary reason the Constitutional Convention met in Philadelphia in 1787. The new Constitution gave the federal government the power to tax and required it to assume the debts of the old government. George Washington’s treasury secretary, Alexander Hamilton, approached the urgent task of refinancing the debt by offering generous terms for bonds and continentals issued during the Revolution. These had mostly fallen into the hands of speculators, who had bought them at very low prices hoping to make a profit when the new government redeemed them.

Many, including Thomas Jefferson and James Madison, felt that the speculators should get no more than what they had paid for the bonds and paper money and only the original owners should be paid the full redemption price. Hamilton argued that it would often be impossible to determine the original holders. Moreover, once a government begins to decide to whom and how much it owes money, he warned, future lenders will charge much higher interest.

Hamilton believed it was in America’s long-term interest to create a well-financed and secure national debt. He admired Britain’s modern financial system, with a central bank and government-issued bonds that were negotiable in the marketplace. Because the holders of British debt were confident of getting the interest regularly from the Bank of England and were able to sell the bonds easily if they chose to do so, they loaned money at low rates and increased the amount of capital available for economic growth.

Hamilton’s program, enacted over the ferocious opposition of Jefferson and Madison, was a success. By 1795, American bonds were selling above par in Europe. In the first year for debt figures, 1792, the national debt stood at $80,359,000. Government outlays that year were a little over $5 million. The government soon began to pay down the debt. By 1811, it was $45 million while the American economy in the previous two decades had grown greatly. The War of 1812 caused the debt to soar to $123 million by 1816. But once again, as peace returned, the government began to pay it down.

Andrew Jackson Pays Down the National Debt and Sinks the Economy

Like many modern politicians, Andrew Jackson denounced government debt as a “national curse” and vowed to eliminate it. When he entered the White House in 1829, the national debt was about $58 million. Six years later America was completely debt free for the first and only time in our history. While making good on his promise, however, Jackson helped plunge the nation into its first great depression.

Jackson had made a tidy personal fortune as a young land speculator in Tennessee, but fell deeply in debt when a complicated deal went bad and left him holding piles of worthless promissory notes. From then on, he viewed debt as a moral failing and denounced banks or individuals who issued paper money of any sort as perpetrators of fraud and corruption.

Jackson saw paying off the national debt as a way of diminishing the power of the “monied aristocracy” who dealt in paper rather than real wealth such as land and manufacturing. For Jackson, the symbol of this monied aristocracy was the Second Bank of the United States and its president, Nicholas Biddle. Its charter came up for renewal in his second term and Jackson killed it off. Meanwhile to achieve his goal of eliminating the national debt, he sold government-owned land in the West and mercilessly slashed spending, including programs to build national roads (the earmarks of that time).

In late 1834, Jackson proudly proclaimed America “free from public debt.” But after he began distributing surplus revenues to state banks that were no longer subject to the discipline of the Bank of the United States, they printed massive amounts of paper money and rampant land speculation ensued. When Jackson tried to stop the speculation by insisting all government land sales, except those where the purchaser intended to settle on the land, had to be paid for with gold or silver, the land boom came to an abrupt halt and Wall Street experienced its first great crash. Jackson, with the luck and timing characteristic of great politicians, retired in 1837, before the full brunt of a depression that crippled the economy for six years and forced the American government to start borrowing again.

War Bonds, Greenbacks and Massive Deficits Help Save the Fractured Union

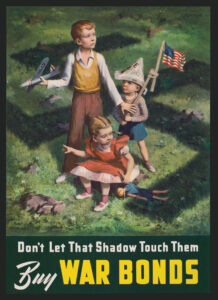

The Civil War, the largest war fought in the Western world between the Napoleonic wars and World War I, placed unprecedented strains on the financial system. To pay for it, the North raised taxes sharply (including putting a tax on income for the first time) and issued $450 million in greenbacks (paper money not backed by gold) and vast quantities of federal bonds.

A gifted Philadelphia banker named Jay Cooke invented the bond drive—a feature of major wars ever since—to raise money. Federal bonds before the 1860s had always been sold privately to banks, to be held in their reserves, and to wealthy individuals. Cooke sold bonds with denominations as low as $50 dollars and gave purchasers as long as six months to pay for them. In all, Cooke sold bonds to about 5 percent of the Northern population when less than 1 percent had bank accounts.

The ability of the North to borrow was a major reason it won the war. The South was forced to finance its war effort by printing money. The ensuing inflation (over 700 percent by 1864) severely disrupted the Southern economy.

At the end of the war, the national debt was a staggering $2.755 billion, well over 40 times its size four years earlier. But, again, the government began to pay it down while the American economy grew steadily. By 1914, the debt was $1.188 billion, only a little more than 3 percent of GDP. Indeed, the richest man in the country, John D. Rockefeller, could have paid off the national debt in its entirety and still have been a very wealthy man.

Big-Time Spending Saves the Economy and Then the World

The Great Depression dramatically changed American attitudes about economic priorities. Before 1930, the first obligation of the federal government, after the defense of the country, was to pay down debt if possible. After the collapse of the American economy, the second most important obligation of the federal government became to prevent another Great Depression. If that meant deficit spending to stimulate the economy, then so be it.

Elected at the depth of the Depression in November 1932, President Franklin Roosevelt accepted the conventional wisdom regarding deficits. During his campaign he lambasted Herbert Hoover’s fiscal mismanagement. “Let us have the courage to stop borrowing to meet continuing deficits,” he said in a radio address. “Any government, like any family, can, for a year, spend a little more than it earns. But you know and I know that a continuation of that habit means the poorhouse.” But when he was in office, his advisers convinced him that “passive deficits,” which derive from falling tax receipts in bad times rather than deliberate increases in spending, should be tolerated. And he made an unbalanced budget a matter of deliberate policy for the first time in the nation’s history.

In the 1930s, the debt rose from $16.1 billion to $42.9 billion, at the same time going from 17 percent of GDP to 50 percent. World War II, like the Civil War 80 years earlier, caused the debt to soar even higher, from $48 billion to $269 billion. In 1946, the debt was 129.8 percent of GDP, by far the highest it has ever been—yet.

After the war, unlike earlier times, the federal government made no attempt to pay down the debt. What it did do, however, was not increase it. In 1947, the government ran the first budget surplus since 1930. In 1960, the debt was $286 billion, a mere 6 percent higher than in 1946. And the American economy had grown prodigiously, with GDP rising from $222 billion to $518 billion. Thus as a percentage of GDP, the debt fell dramatically in the postwar era, dropping from 129.8 percent to 57.5 percent.

Keynesianism Gives Pols an Excuse to Keep Unbalanced Books

By the 1960s, the theories advanced earlier in the century by the British economist John Maynard Keynes strongly influenced American policy. Unlike the 18th-century Scottish economist Adam Smith, who argued that free markets were guided by an “invisible hand,” Keynes viewed a national economy as a machine and thought that the government should serve as the engineer. He also felt that a national debt was not like a personal debt, because the government owed the money to its own citizens. So, Keynes reasoned, it was like one family member owing money to another. The net worth of the family remains unchanged.

Franklin Roosevelt, Harry Truman and Dwight Eisenhower, all of whom were born in the late 19th century, were reluctant to run up deficits except in times of war or economic crisis. “I don’t think you can spend yourself rich,” said Eisenhower’s secretary of the treasury, George Humphrey. But the younger generation that came to power with John F. Kennedy eagerly embraced the ideas of Keynes. Walter Heller, Kennedy’s chief economic adviser argued for a full-employment budget, with outlays equaling what would be government revenues if there were full employment (usually defined as unemployment at 4 percent). Heller also argued for “fine-tuning” the economy, a thoroughly Keynesian notion.

The elegance of Keynes’ theory was not the only reason politicians found it attractive. As James Madison noted two centuries earlier, “men love power.” By enlarging the scope of legitimate political action, Keynesianism enlarged the power of politicians. And politicians have a natural inclination to spend (although they may disagree fiercely as to what to spend on), and thus earn the gratitude of the beneficiaries of the spending. They are equally disinclined to tax and earn the ire of their constituents.

Under the old consensus regarding deficits and the national debt, pleasing both halves of the body politic had been impossible. Politicians had to choose between them and hoped they guessed right and so kept their jobs. But Keynesianism gave them a heaven-sent justification for both high spending and low taxes.

While government spending more than doubled in the 1960s, revenues largely kept pace, even with—and some would argue because of—the Kennedy tax cuts. The national debt increased over the course of the decade by 29 percent. But because of the great prosperity of the decade, the debt as a percentage of GDP fell from 57.7 percent to 39.2 percent.

The Debt Explodes and Becomes a National Curse Again

The Keynesian model of the economy and the national debt both went off the tracks as the ’60s drew to a close and President Lyndon Johnson’s attempt to have both guns (the Vietnam War) and butter (the Great Society) caused inflation to heat up. Unemployment rose and economic growth slowed in the ’70s under Presidents Richard Nixon, Gerald Ford and Jimmy Carter even as the country reached the highest level of peacetime inflation ever by the end of the decade. The combination, impossible in Keynesian theory, was dubbed “stagflation.”

In the early 1980s, Paul Volcker, chairman of the Federal Reserve, and President Ronald Reagan brought inflation to a screeching halt by inducing a deep recession. Unemployment reached 10.8 percent in 1982. Reagan wanted tax cuts and increased military spending, and Congress obliged. But Congress wanted increased spending elsewhere as well. The deficits, despite the gathering prosperity, continued and only got larger. Over the course of the decade, the national debt more than tripled from $909 billion to $3.2 trillion and rose as a percentage of GDP to more than 58 percent.

In the mid-1990s, growing concern over the debt led a Republican Congress to give Democrat Bill Clinton something every president since Ulysses S. Grant had asked for: a line-item veto on the budget. (It was later thrown out by the Supreme Court.) After a brief period of spending restraint, 1998 was the first fiscal year in nearly three decades that the federal budget was actually in surplus, at least by government accounting methods. And the period 1998-2001 was the first time there had been four surplus years in a row in nearly half a century.

The respite from debt worries was short-lived. Under President George W. Bush, spending went unchecked and the debt began, once again, to expand as a percentage of GDP as well as in dollar terms. With the financial crisis of 2008 and the ensuing deep recession, government deficits reached new heights.

Now Republicans and Democrats alike pay lip service to the urgent need for fiscal reform, but it will be uphill work as long as both parties find it inconvenient to say no to one special interest group or another. It won’t happen quickly either. It took several decades of fiscal mismanagement and political irresponsibility for the United States to reach this point, and under the best circumstances, it will take at least a decade to restore the national debt to the blessing Alexander Hamilton envisioned, not the curse we carelessly let it become.

John Steele Gordon is a financial journalist and economic historian based in New York.

Originally published in the October 2011 issue of American History. To subscribe, click here.